- The KSE-100 index hit an intraday high of 109,478.08 points.

- The benchmark index crossed the 100,000 mark seven days ago.

- The rally continues after the refinancing of $3 billion of Saudi deposits.

The stock market continued its record streak on Friday, surpassing the 109,000 mark during intraday trading, fueled by improving macroeconomic fundamentals, including an increase in Pakistan’s foreign exchange reserves.

The KSE-100 index of the Pakistan Stock Exchange (PSX) hit an intraday high of 109,478.08 points. However, it closed at 109,053.95 after a gain of 814.99 points or 0.75%, up from the previous close of 108,238.96 points.

This remarkable rebound reflects a week of rapid growth for the PSX, which crossed the 100,000 mark just seven days ago.

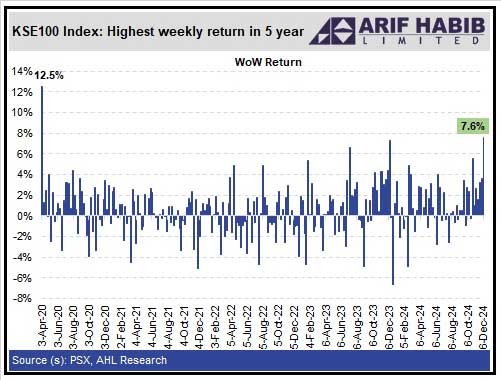

In the week ending December 6, 2024, the KSE-100 index jumped 7.6%, reaching an all-time high of 109,054 points. This is its highest weekly return since April 3, 2020.

Additionally, PSX achieved another milestone as the average weekly trading volume and value reached an all-time high of 1.7 billion shares and Rs 55 billion, respectively, during the week.

Ahsan Mehanti, Managing Director and CEO of Arif Habib Commodities, said: “The bullish market trend is driven by certain stocks in the oil and banking sectors, driven by speculation ahead of the SBP’s policy rate announcement. next week. »

“The refinancing of Saudi deposits of $3 billion, the stability of the rupee and the optimistic economic indicators played a catalytic role in this new record of PSX,” he added.

Pakistan’s total liquid foreign exchange reserves reached $16.6 billion as of November 29, 2024, according to the State Bank of Pakistan (SBP).

These reserves include $12 billion held by the SBP, which increased by $620 million during the week, thanks to an official inflow of $500 million from the Asian Development Bank (ADB).

Additionally, the Saudi Fund for Development (SFD) extended the duration of a $3 billion deposit maturing on December 5, 2024 by one year.

This extension follows a meeting between Prime Minister Shehbaz Sharif and Saudi Crown Prince Mohammad Bin Salman during the “One Water Summit” in Riyadh.

“Expectations of a 150-200 basis point rate cut and increased liquidity flowing into stocks as funds move away from fixed income are the reasons for the continued uptrend,” a said Sana Tawfik, Head of Research at Arif Habib Limited. “Moreover, low market multiples are giving way to further increases.”

At the same time, another reason for the market rise is the inflation rate, which fell to 4.9% in November, its lowest level since 2017, leaving room for further monetary easing. This marks a sharp decline from last year’s all-time high of 38% and is well below the SBP’s target range of 5-7%.

Most analysts expect the SBP to cut interest rates by at least 200 basis points at its December 16 meeting, which would bring the total reduction to 900 basis points since June.

As the PSX approaches the 110,000 mark, market analysts remain optimistic about continued growth.

With strong macroeconomic indicators, rising reserves and the likelihood of a significant rate cut, the capital market is positioned to see sustained momentum heading into the final weeks of 2024.