- Positive macroeconomic indicators are fueling the record market rally.

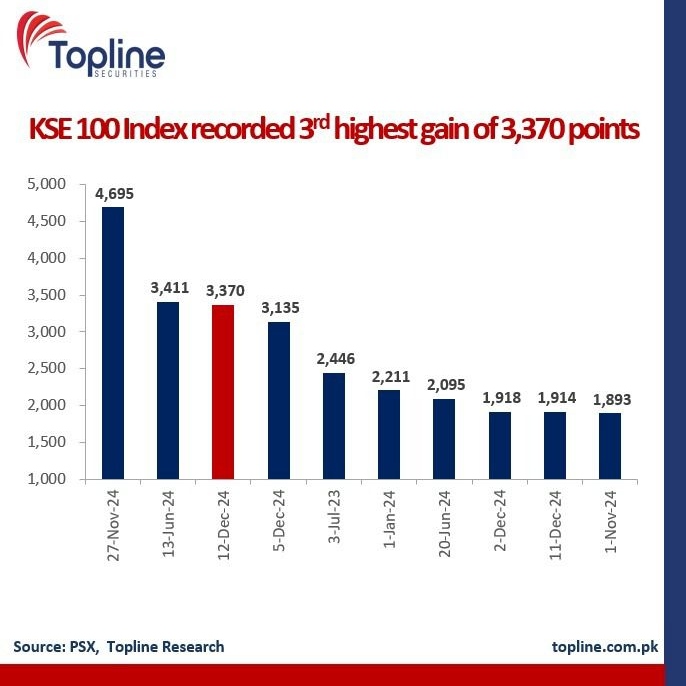

- This is the third highest point gain ever for the KSE-100 index.

- Successive rate cuts push investors from bonds to stocks.

The stock market hit another milestone on Thursday, with the KSE-100 index surpassing the 114,000-point mark for the first time in its history.

Supported by positive macroeconomic indicators, growing investor optimism and expectations of significant monetary easing, the benchmark index hit a new record high.

The KSE-100 index of the Pakistan Stock Exchange (PSX) jumped 3,370.29 points, or 3.04 per cent, to close at 114,180.5 points. It also hit an intraday high of 114,408.62, marking another milestone in the market’s ongoing recovery.

“Liquidity is a very important factor for the stock market. With successive rate cuts, investors have shifted from bonds to stocks,” said Sana Tawfik, head of research at Arif Habib Limited.

“The IMF program and other economic measures have also brought significant improvements in key indicators, including inflation and foreign exchange reserves,” she added.

Pakistan’s current account deficit (CAD) recorded a sharp decline of 79% year-on-year, narrowing to $217 million in the first two months of FY2025, with August even reflecting a surplus of $29 million, supported by strong inflows and stable export earnings.

Exports are expected to reach $33 billion by the end of fiscal 2025, driven by improving domestic production, stable exchange rates and robust growth in major trading partner economies. Exports of services, including IT, are expected to increase from $3.2 billion in fiscal 2024 to $4.2 billion in fiscal 2025.

Additionally, remittances are expected to increase by up to $33.5 billion in fiscal 2025, aided by reduced global inflation and government initiatives promoting formal banking channels. The government has allocated Rs 80 billion for transaction rebates and incentives to encourage the flow of funds through legal channels, thereby contributing to economic stability.

The government’s decision to cut Treasury yields by up to 100 basis points on Wednesday further fueled expectations of monetary easing. The auction raised 1.256 trillion rupees against a target of 1.2 trillion rupees, with the highest bids for longer-term securities, signaling investor confidence in the economy.

The largest drop in yield of 100 basis points was on three-month securities, bringing the rate from 12.99% to 11.99%. Analysts predict that the State Bank of Pakistan (SBP) may cut its policy rate by up to 200 basis points at its December 16 meeting, reflecting falling inflation, which reached 4.9 percent in November, its lowest level since April 2018.

The banking sector’s advance-to-deposit ratio (ADR) improved to 47.8% as of November 29, 2024, from 44.3% in October, as banks strive to reach the mandatory 50% threshold by on December 31. in additional taxes on income from public securities.

Additionally, the government revised the National Savings Scheme (NSS) profit rates, with the savings account rate falling by 250 basis points to 13.5 per cent. These changes are expected to redirect funds into stocks, further fueling market activity.

Economic activity remains robust, as evidenced by a 62% year-on-year increase in passenger car sales in November and a 50% rise in the first five months of fiscal 2025. Additionally, the Asian Bank of Development Agency (ADB) has approved $530 million in loans to modernize Pakistan’s power distribution infrastructure and strengthen social welfare programs.

Saudi Arabia’s extension of a $3 billion deposit and trade deals worth $560 million boosted foreign exchange reserves and boosted investor confidence, underscoring confidence in economic recovery of Pakistan.

The PSX rally reflects growing confidence in Pakistan’s economic stability, supported by falling inflation, strong remittance inflows and improving liquidity.

As the SBP’s monetary policy meeting on December 16 approaches, expectations of significant rate cuts are expected to support investor momentum, ensuring continued market growth.