- FBR chairman urges people to pay their taxes.

- He says the tax rates are wrong and should be corrected.

- The objective is to bring the richest individuals to net-of-tax income.

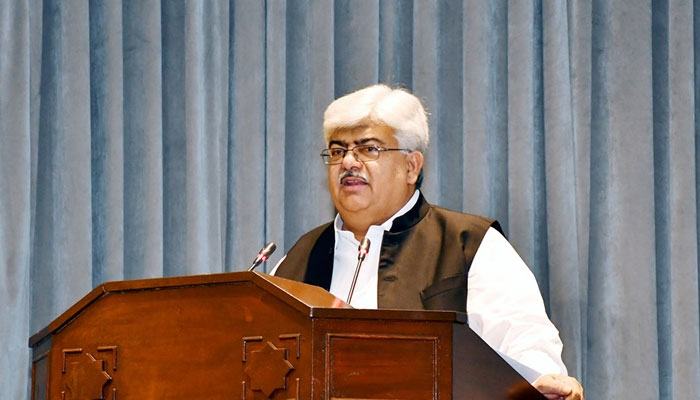

Slamming the culture of tax evasion in the country, Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial said those who give advice on how to fix the system later turn out to be tax evaders .

The FBR faced a large fiscal deficit of Rs 386 billion from July to December, according to The News. Revenue collection stood at Rs5.623 billion during the first six months of the current fiscal year, short of the desired target of Rs6.009 billion.

The IMF had given an indicative target of Rs6,009 billion till end-December 2024, but the FBR managed a net collection of Rs5,623 billion during the first six months of the current fiscal year.

Addressing an event, the FBR chairman said that those liable to pay tax were not fulfilling their responsibilities properly.

There are problems among taxpayers and tax collectors, he said, adding that tax rates in the country were not right.

“Tax rates in Pakistan are wrong and should be corrected,” he added.

The president said the tax system was designed to bring the top 5 percent of the wealthy into the tax net. He has pledged to collect revenue worth Rs13.5 trillion this year.

Replying to a question, the FBR chairman said, “Pakistan is not among the overtaxed countries. »

Neither they paid full taxes nor got full services in return, Langrial added.

The salaried class is included in the tax net as the authorities concerned have failed to collect taxes from the rich.

The government was aware that the tax rate on certain products needed to be reduced, the FBR chief said.

He said the government would introduce a new law that would make shopping difficult for those who have not submitted their tax returns.

More than 0.4 million retailers have been included in the net tax this year, he said, adding that retailers have not yet disclosed their monthly income. He also stressed the need to end the smuggling of petroleum products.