The capital market started the week on a positive note, building on last Friday’s momentum, driven by easing political uncertainty and improving macroeconomic indicators.

Investor confidence was boosted by the conviction of former Prime Minister Imran Khan and his wife, Bushra Bibi, in a much-anticipated verdict last Friday, which provided a sense of closure and lowered the political temperature.

Expectations of supportive monetary policy and solid current account data further contributed to this positive dynamic.

“The market reacted positively to last Friday’s political development that Khan was not acquitted as it now sees a drop in the political temperature in the short term,” said Muhammad Saad Ali, director of the research at Intermarket Securities Ltd, addressing Geo.tv.

“Politics is one of the main reasons why the market has stagnated over the past two weeks,” he added.

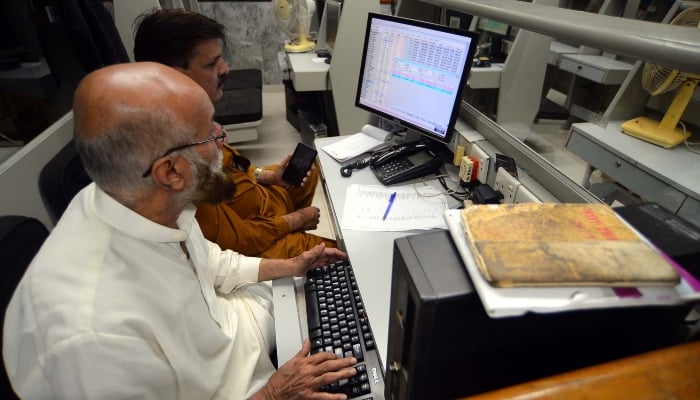

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 index climbed 929.77 points, or 0.81 per cent, to hit an intraday high of 116,201.85 on Monday. The market also recorded a low of 115,732.88, with trading activity reflecting investors’ renewed confidence in a more stable political and economic outlook.

In a crucial ruling, accountability court judge Nasir Javed Rana sentenced Khan and his wife to 14 and seven years in prison respectively, while also imposing substantial fines on them. The politically significant verdict ended weeks of speculation, easing market concerns about prolonged political instability.

Finance Minister Muhammad Aurangzeb announced the government’s plan to launch Panda bonds by June 2025 to strengthen Pakistan’s engagement with Chinese capital markets.

Speaking in an interview, he said Pakistan plans to raise around $200 million from Chinese investors through the issuance of the Panda Bond. He added that the initiative is part of a broader strategy to move the economy towards export-led growth and a sustainable balance of payments.

The move is part of the government’s ongoing efforts to widen the tax net and meet the conditions of the International Monetary Fund (IMF) under the $7 billion Expanded Financing Facility (EFF).

According to a statement issued by the Prime Minister’s Office on Sunday, Prime Minister Shehbaz Sharif also highlighted the importance of digital growth, welcoming Pakistan’s inclusion in the World Economic Forum (WEF) and the Digital Investment Initiative foreign direct from the Digital Cooperation Organization (DCO). DFDII).

The first project of this initiative will focus on exports of digital infrastructure and services, with the aim of attracting significant foreign direct investment (FDI).

The country’s net FDI increased by 31 percent to $1.124 billion in the first five months of the current fiscal year.

Adding to this optimism, the State Bank of Pakistan (SBP) reported a current account surplus of $1.2 billion for the first half of FY25, the highest surplus in 15 years . The surplus was bolstered by increased remittances and export growth. For the month of December alone, the surplus amounted to $582 million, an increase of 109% year-on-year.

On the inflation front, the sensitive price indicator (SPI) recorded a year-on-year rise of 1.16% for the week ending January 16, the lowest rate in months. A 0.39% weekly decline in the SPI reflects falling prices in major food categories.

Analysts expect this moderation in inflation to influence the SBP’s monetary policy, with potential revisions to the current policy rate of 13%, further boosting investor confidence.

Last week, the KSE-100 index gained 2,025 points (+1.8% week-on-week) to close at 115,272 points, reflecting attractive valuations and a search for institutional value.

With favorable economic indicators and expected monetary easing, the market is expected to maintain its positive momentum in the coming sessions. However, political uncertainty and crude oil price volatility remain major risks for investors.