- The central bank has reduced interest rates since June 2024.

- Inflation should go further in January before going up.

- Pakistan economy increased by 0.92% in the first quarter of the fiscal year.

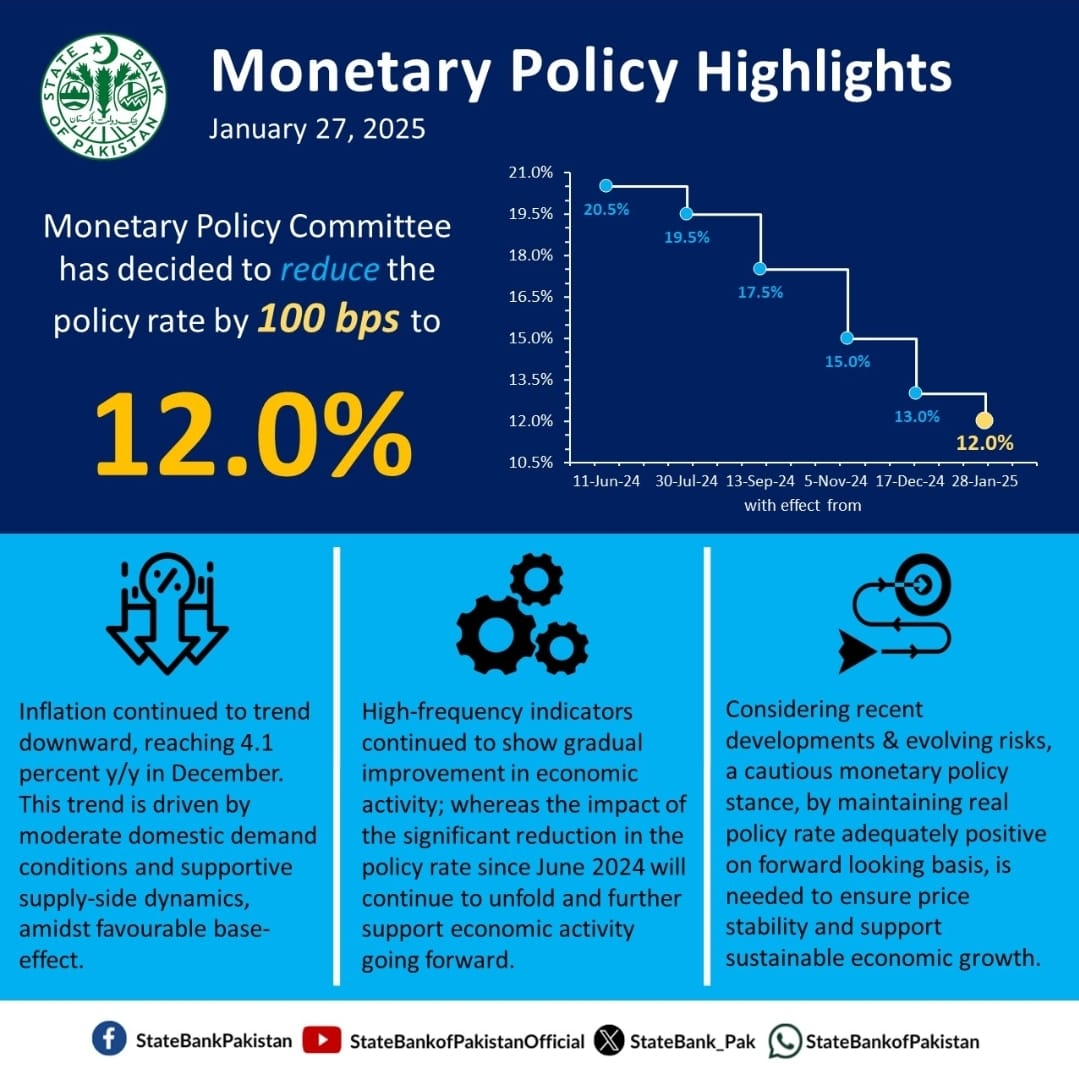

The Pakistan State Bank (SBP) reduced its 100 basic point policy rate to 12% on Monday, said the Governor of the Central Bank Jameel Ahmed Inflation.

The governor of the bank declared at a press conference that the inflation rate was going further in January, but that basic inflation had remained high, adding that the annual inflation forecasts of the year at June was on average 5.5% to 7.5%.

“Given these developments and evolutionary risks, the Committee noted that a prudent position of monetary policy is necessary to guarantee price stability, which is essential for sustainable economic growth,” said the monetary policy committee of The bank (MPC) in a press release accompanying the decision.

“In this regard, the MPC has assessed that the real policy rate must remain properly positive on a prospective basis to stabilize inflation in the target beach from 5 to 7%,” the statement said.

The central bank has reduced interest rates since June 2024, reducing a total of 1,000 basic points on the 22%record.

This marks one of the most aggressive rate reduction campaigns among emerging markets, exceeding 625 basic points reduced during the COVID-19 pandemic in 2020.

Significant reduction

The Committee said that the impact of this significant reduction in the rate since June 2024 will continue to take place and further support economic activity.

Inflation continued to decrease in accordance with expectations, reaching 4.1% in annual shift in December, noted the committee.

“This trend is driven by moderate domestic demand conditions and the dynamics of supply support, in the midst of the favorable basic effect,” the SBP said in its press release.

The consumer inflation rate has slowed down to a 6-1/2 years lower by 4.1% in December, largely due to a high base of the year.

It was lower than government forecasts and significantly less than a summit of several decades of around 40% in May 2023.

“At the same time, high frequency indicators have continued to show a gradual improvement in economic activity,” he added.

GDP growth forecasts

The governor said that the bank had maintained its growth forecasts for annual GDP at 2.5% to 3.5% and said economic growth would increase over the next six months, which would help stimulate exchange reserves of the country before in difficulty.

“Improvement of the prospects of the current account, as well as the expected realization of the planned financial entries, should increase the exchange reserves of the SBP beyond $ 13 billion by June 2025,” said the bank’s statement .

However, the SBP has also highlighted several risks of inflation, including protectionist policies for “major economies”.

US President Donald Trump said he was planning to impose prices on goods from several countries.

IMF and debt maintenance

To a question, the governor said that all the measures required by the International Monetary Fund (IMF) on the side of the Central Bank have already been taken and that they are convinced that the fund examination will be expected.

The Governor of the SBP also mentioned that $ 7.3 billion in debt reimbursement had already been reduced during this exercise to date and have stressed that new policy changes would not have a major impact on the government debt service.

Answering another question, he also excluded any concern about the exchange rate for the moment.

Ahmed said that once the investpak platform launched, the general public and businesses will be able to buy government securities directly.

Pakistan’s economy increased by 0.92% in the first quarter of the 2024-25 financial year which ended in June, according to data approved by the National Committee of Accounts and published by its statistical office in December.

The committee noted: “First, the real growth of GDP in Q1-Fy25 was slightly lower than the previous expectations of the MPC. Second, the current account remained in December 2024, although the exchange reserves of the SBP have decreased in the midst of low financial entries and high reimbursement debt.

“Third, despite a substantial increase in December, tax revenue remained below the objective in H1-Py25. Fourth, world oil prices have shown increased volatility in recent weeks.

“And finally, the global economic policy environment has become more uncertain, which prompted central banks to adopt a prudent approach,” the statement said.