- IFC doubles Pakistan, considering funding for large infrastructure.

- Focus on investment in the infrastructure, agri, digital, financial sectors.

- Said that the country needs investment in projects such as airports, energy, ports.

After having kept key meetings with leaders of the finance division, the chief of the International Finance Corporation (IFC) said Thursday that an annual investment of $ 2 billion “was not a large number” for Pakistan , which needs infrastructure development in airports, energy, water and ports, Reuters reported.

The director general of IFC and executive vice-president, Makhtar Diop, visiting Pakistan, following the World Bank’s plans to allocate up to $ 20 billion in Pakistan as part of a national partner framework Announced (CPF) announced in January, IFC also interrupted to invest the same amount.

“By October, we will be able to progress enough on a few transactions which will indicate that it is a country ready to receive large -scale funding for critical and important infrastructure,” said Diop Reuters.

Pakistan, which has considerably avoided a defect in sovereign debt, is currently less than a rescue program for the international monetary fund of $ 7 billion and sails in a delicate path to the recovery.

Exchange reserves is not enough enough to respond to a month of controlled imports, the country desperately needs external funding for development projects.

IFC experienced an exposure of $ 2.1 billion in Pakistan during the year 2024, ending in June, marking its record investment in the economy of $ 350 billion in the country, which increased by 0 , 92% in the first quarter of the financial year.

Diop said IFC examined agriculture, infrastructure, the “very important” financial sector and the digital sector.

The government seeks to generate income by accelerating a privatization thrust, but efforts to privatize the national flag carrier, the Pakistani international airlines and the outsourcing of the capital’s airport has fallen flat.

In accordance with IFC’s global thrust, DIOP said that actions -based transactions should also be expected in Pakistan.

“Debt will always be a very important role in our company, but our equity will increase in the world, but also in Pakistan. This means that we really believe in Pakistan because we can take capital.

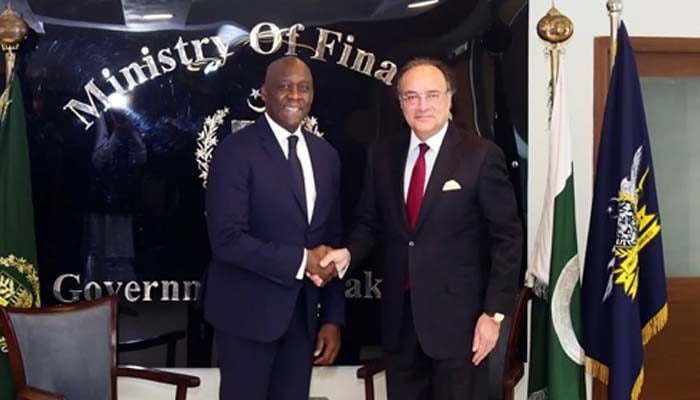

Earlier in the day, an IFC delegation met those responsible for the finance division on Thursday to discuss policies aimed at stimulating industry growth, in particular through expansion led by export.

“IFC undertakes to work closely with Pakistan and provide support in key areas such as green energy, data centers, improvements in the agricultural supply chain, the telecommunications sector And digitization, ”said Makhtar Diop, Managing Director and IFC Executive Vice-President in a high-level meeting at the Finance Division.

During the meeting with the Minister of Finance Mohammad Aurangzeb and his team, Diop, leading the delegation of senior IFC officials, congratulated the Pakf agreement of Pakistan with the World Bank, describing it as global practices.

Last month, the World Bank, which currently hired around $ 17 billion in Pakistan for 106 projects, said that political and institutional reforms to stimulate growth in the private sector and extend budgetary space for investment government in crucial fields would also be essential.

Since 1950, the World Bank has provided more than $ 60 billion in funding in Pakistan; However, the new program represents a longer -term strategy compared to previous agreements, which generally extended from four to six years.