- The market ends at 117,974.02, up 972.93 points.

- Intraday High reaches 118,243.63, winning 1,242.54 points.

- The bottom of the day recorded at 116,882.80, down 118.29 points.

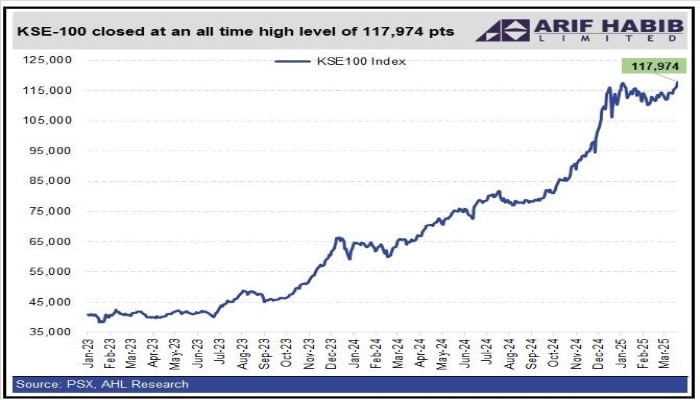

The stock market has reached a summit of all time on Wednesday, continuing its bullish momentum while investors’ confidence has remained strong.

The market has gained ground after optimism surrounding progress in solving circular debt problems.

The KSE-100 index of the Pakistan Stock Exchange (PSX) jumped 972.93 points, or 0.83%, to end at 117,974.02, against 117 001.09 of the previous session. The index reached an intraday summit of 118,243.63, while the lowest point in the session was recorded at 116,882.80.

According to ARIF HABIB Limited, it was the high level of all time at the end of the session for the KSE-100 index, a milestone which reflects the resilience of the market in the midst of broader economic recovery efforts.

The rally was largely motivated by optimism surrounding the potential resolution of the circular debt and a treasury infusion in the energy sector, which was a key concern for the economy.

“The potential resolution of the circular debt and the cash infusion in the energy chain stimulates today’s market gains,” said Samiullah Tariq, research manager at Pak-Kuwait Investment Company.

In the energy sector, oil exports from the Pakistanian Four reached a record of 933,000 tonnes in the first eight months of the current year, while the country continues to remove its use due to high costs and environmental concerns.

However, Mazout exports fell to 39,000 tonnes in February, against 190,000 tonnes in January. Industry sources have assigned the decline to an accumulation of furnace oil in local refineries, as buyers prefer bulk purchases.

Energy production data for the 2024 July-February period revealed that furnace oil is now playing a minimum role in the energy mixture of Pakistan. The new government refining policy aims to reduce the production of oven oil to Sulfur by 78%, reducing the daily production of 15,500 metric tonnes to 3,400 metric tonnes once the upgrades are planned.

Meanwhile, exports of information technology (IT) from Pakistan has maintained their upward trajectory, registering $ 305 million in February, reflecting an increase of 19% in annual shift (annual shift). However, exports decreased by 3.0% on the basis of one month by month (MOM). This marks the 17th consecutive month of growth in annual shift in IT exports, which reached $ 2.48 billion in the first eight months of financial year 25, up 26% compared to the previous year.

Topline Securities analysts have allocated the increase in annual sliding of IT exports to several factors, including global expansion customers for Pakistani companies, in particular in the Gulf Cooperation Council (GCC) region.

Additional factors included the Pakistan State Banking Policy Changes (SBP) allowing IT companies to keep a higher part of their currency profits and increasing stability in the Roupie, which encouraged exporters to bring back a larger share of their profits to Pakistan.

Investors responded positively to the reports that the IMF approved Pakistan’s request to borrow 1.25 Billion of rupees ($ 4.5 billion) from national banks to help reduce its mounting circular debt without adding to official public debt.

This agreement, finalized during political discussions between the Pakistani authorities and the IMF, provides an essential fiscal breathing room while attacking ineffectures in the electricity sector.

To finance these loans, Pakistan will continue to take an RS3 per kilowatthe-hour the service supplement (DSS) on electricity bills, which should generate more than 300 billion rupees per year. The government also plans to withdraw 1.5 billion of circular debt rupees thanks to a combination of loans and bank funds from surcharge.

In addition, renegotiations with independent electricity producers (PPI) should produce savings of 463 billion rupees by lowering capacity payments and adjusting tariff structures.

The IMF approval of this restructuring of the debt underlines its commitment to support the structural reforms of Pakistan under the prolonged fund of funds of $ 7 billion (EFF). Government representatives have ensured the fund that improves collection practices and the improvement of operational gains will prevent the accumulation of future debts.

The Minister of Power Awais Ahmed Khan Leghari said that even if the government had not yet received an official decision, it remains optimistic that the IMF approved the borrowing plan. He said that the DSS will remain unchanged, remaining below RS3 per unit as part of the negotiations of final sheets with the banks.

The IMF also shared a memorandum of economic and financial policies (MEFP) with the Pakistani authorities, another step towards the finalization of the process of examining in progress.

The fund has indicated a desire to relieve the construction and real estate sectors, although it is not clear if such incitations will be implemented immediately or in the next budget budget.

Pakistan and the IMF team concluded discussions last week without concluding an agreement at the staff level (ALS), which is a prerequisite for Islamabad’s demand to officially request the next $ 1 billion tranche under the EFR. Consequently, additional political negotiations are expected in the coming days before the IMF executive council examines the case of Pakistan.

The PSX continued its gathering on Tuesday, reflecting the growing market confidence in the current economic reforms. The KSE-100 reference index has climbed 801.50 points, or 0.69%, to end at 117,001.09, up compared to the previous fence of 116,199.59. The index reached an intraday summit of 117 202.09, while the lowest level recorded during the session was 116,490.82.