- Unemployment to remain stable at 8%.

- Inflation was observed at 7.7% next year.

- Current account deficit to reach 0.4%.

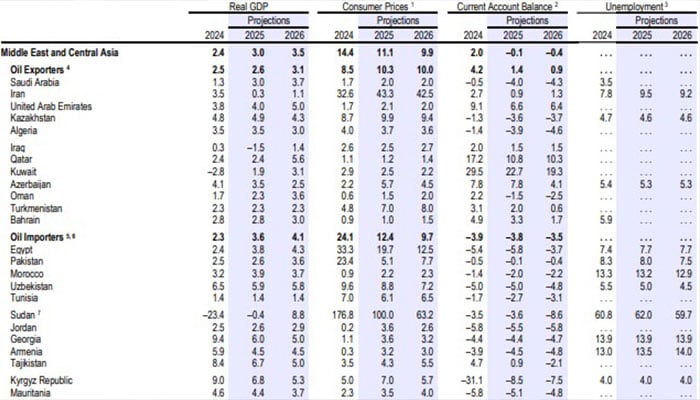

Islamabad: The International Monetary Fund (IMF) lowered Pakistan’s economic growth projection for the current financial year to 3% to 2.6% in its report on the global economy published this week.

Revised forecasts follow new US tariff increases up to 29% by President Donald Trump, who led the IMF to reduce growth estimates for several development economies.

The report, however, noted that Pakistan GDP growth for the next financial year (2025-2026) is expected to reach 3.6%.

Inflation in Pakistan – which amounted to 23.4% in 2024 – is scheduled for 5.1% for the current financial year, the IMF providing more at 7.7% in the next fiscal year.

The IMF has also revised its forecasts for the deficit in the current account of Pakistan. It now expects the deficit to amount to 0.1% of GDP, compared to its previous estimate of 1%. In nominal terms, the current account difference should be only $ 400 million, instead of the previously projected $ 3.7 billion.

For 2026, the lender expects the current account deficit to increase even to 0.4% of GDP.

The unemployment rate should remain 8% in 2025, compared to 8.3% in 2024 – with an additional decrease of 7.5% in 2026, according to the report.

IMF’s global economic prospects have stressed that the recent tariff climbing of the United States has led to a general weakening of growth forecasts in emerging markets and developing economies.

Pakistan, as well as several other countries in the Middle East and Central Asia, are expected to cope with economic pressures due to disrupted trade and the increase in global funding costs.

The report is accompanied by the context of the presence of the Minister of Finance Muhammad Aurangzeb in Washington for the World Bank group and the Spring 2025 meetings of the IMF during which the Minister held several key meetings with business leaders and those of financial institutions.

Aurangzeb, during her meeting with the director general of the IMF, Kristalina Georgieva, reaffirmed the government’s commitment to reforms.

Meanwhile, attending a round table hosted by the IMF entitled “The mobilization of medium -term income”, the financial Czar described Islamabad’s efforts to widen and deepen the tax base to ensure that sectors such as agriculture, real estate and retail trade contribute to the GDP.

In addition, during a meeting with institutional investors, he also underlined the country’s macroeconomic stabilization and the recent upgrading of credit rating by Fitch, which opened ways for the return of Pakistan to the financial markets thanks to increased investor confidence.

The revised forecasts of the lender based in Washington are not limited to Pakistan but include several countries as well as world statistics, The news reported Wednesday.

In its report, the IMF has reduced its global growth forecasts by 0.5 percentage points to 2.8% for 2025, and 0.3 percentage points to 3% compared to its January forecasts that growth would reach 3.3% in the two years.

He said inflation was to decrease slowly than scheduled in January, given the impact of prices, reaching 4.3% in 2025 and 3.6% in 2026, with “notable” revisions for the United States and other advanced economies.

The IMF qualified the “reference forecasting” report on the basis of developments until April 4, citing the extreme complexity and fluidity of the current moment.

“We are entering a new era because the global economic system that has operated for 80 years is being reset,” said journalists, chief economist of the IMF, Pierre-Olivier Gourinchas.

“This is quite important and it strikes all regions of the world. We see lower growth in the United States, lower growth in the euro zone, lower growth in China, lower growth in other parts of the world,” said Gourinchas Reuters in an interview.

“If we get an escalation of trade tensions between the United States and other countries, this will feed an additional uncertainty, which will create additional volatility from the financial markets, which will strengthen financial conditions,” he said, adding that the group effect could further reduce global growth prospects.

– Additional application of the application