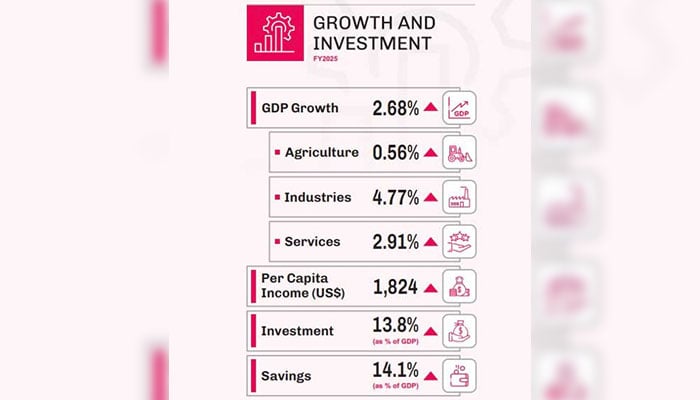

Islamabad: Federal Minister for Finance Muhammad Aurangzeb, while presenting Pakistan Economic Survey 2024-25 Monday (today), revealed that the country’s gross domestic product (GDP) increased by 2.7% with inflation to 4.6% during the outgoing financial year.

The survey is important before the annual federal budget – which should be deposited in the National Assembly tomorrow (Tuesday) – offering detailed information on the country’s socio -economic performance during the outgoing financial year. It includes statistics related to GDP growth, tax revenue, the position of various industries and other key tax and economic indicators.

These include inflation, trade and balance of payments, public debt, population growth, the level of employment and the impacts of climate change. By presenting a consolidated vision of these indicators, the investigation aims to shed light on the public debate and to guide the planning of policies in the conduct of the new exercise.

By disclosing key statistics, the financial TSAR underlined the major reduction in the policy rate of 22% to the current 11% and pointed out that there were record recovery in the electricity sector gracious of the reforms.

Noting that there was a 7% increase in Pakistan exports, Aurangzeb highlighted the country’s growing information technology (TI) and said that the self -employed won up to $ 400 during the outgoing financial year, while IT exports amounted to $ 3.1 billion.

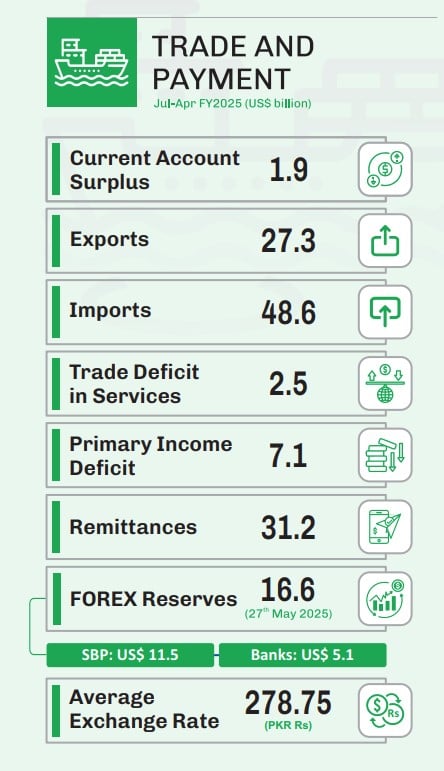

With an increase of 11.7% of imports, the deficit in the current account, he added, reflected an excess of $ 1.9 billion (July to April) as well as a 26% increase in income collection.

On the very important issue of funding from funds – which are a key source of exchange for a much appreciated exchange rate – the Federal Minister said he witnessed an increase of about $ 10 billion in two years.

With regard to the continuous efforts of the government to extend the tax net, the Minister of Finance said that the number of individual declarants had doubled during the outgoing financial year.

Commenting on the country’s economic resumption, the financial Czar said that Islamabad had recovered in terms of GDP growth compared to global growth.

Noting that global inflation was 6.8% in the past two years and was currently 0.3%, he said that the country’s Forex reserves have had a remarkable increase in the current year.

“We must now evolve towards the stabilization of GDP,” he said, adding: “We are currently going in a better direction”.

Pakistan regularly increases on the ascending trajectory with growth in GDP projected at 5.7% in the medium term, he noted.

Shrewing the goalkeeper’s government for holding the country on the right track with regard to the International Program of the Monetary Fund (IMF), the Minister of Finance, accentuated that reforms were necessary to change the “DNA” of the Pakistani economy.

“The government has made reforms to improve the performance of the Federal Board of Return (FBR),” he said, stressing that each economic transformation required two to three years to manifest itself.

Income

In tax terms, total income increased from 36.7% to Rs13,367.0 billion from July to March2025. This included an increase of 26.3% of tax revenue to 9,300.2 billion rupees and a high increase of 68% of non -tax revenues to 4,229.7 billion rupees. The tax collection of the FBR corresponded to the overall tax figure, also to 9,300.2 billion rupees. The budget deficit has narrowed to 2.6% of GDP, while the main balance posted a surplus of RS3 468.7 billion, which is equivalent to 3.0% of GDP.

Sending

In the meantime, between July 2024 and April 2025, Pakistan received a total of $ 31.2 billion in versions, marking an increase of 31% in annual sliding compared to the 23.8 billion dollars recorded during the same period during the 2010 financial year. The increase in payment entries played a decisive role in supporting the surplus of the current account of $ 1.9 billion country.

Inflation

On the monetary front, the inflation of the IPC was on average 4.7% in July-April FY2025, with inflation in April 2025 to 0.3%, marking a hollow of several decades. Although the basic inflation figures were not explicitly stated, the Pakistan State Bank has reduced the policy rate by 1,100 basic points since June 2024 in response to the relaxation of price pressures. Kibor also dropped to 11.3%.

Agriculture

During the 2010 financial year, the agricultural sector of Pakistan recorded a modest growth of 0.56%. In this sector, significant crops decreased by 13.49%, while the cotton surface dropped by 19.03%. Conversely, cattle demonstrated solid performance with an increase of 4.72%, and other crops increased by 4.78%.

The crops that took a blow include corn (-15.4%) and rice (-1.4%). Unlike the yield of potato and onion crops increased by 11.5% and 15.9% respectively.

Industrial sector

The industrial sector posted growth of 4.77%during the 201025 financial year. However, performance varied according to sub-sectors: mining and career decreased by 3.38%, and large-scale manufacturing (LSM) contracted by 1.53%. On the positive side, the supply of electricity, gas and water jumped 28.88%, while construction recorded growth of 6.61%.

Service sector

The service sector increased by 2.91% during the 201025 financial year, with mixed trends between its components. Bost and retail trade experienced a minimum growth of 0.14%, while transport and storage improved by 2.20%. The finance and insurance sub-sector increased by 3.22%, general government services increased considerably by 9.92%and other private services increased by 3.64%.

External sector

The external sector has shown encouraging signs. Exports increased by 6.4% reaching $ 26.9 billion, and imports increased by 7.5% to $ 48.3 billion, which causes a trade deficit of $ 21.3 billion. However, the current account displayed an excess of $ 1.9 billion, a notable turnaround. The exchange rate stabilized at Rs278.72 by US dollar, and exchange reserves reached $ 16.64 billion.

Bisp, social protection

In terms of social protection, the government allocated 471 billion rupees to the Benazir income support program (BISP) during the 20125 financial year. The Benazir Kafaalat initiative disbursed RS366.9 billion to 8.5 million families, while Benazir Taleemi Wazaif provided 55.4 billion rupees to support the education of 7.96 million children. In addition, Benazir Nashonuma extended 5.48 billion rupees for the benefit of 0.7 million mothers and children.

This is a story in development and is updated with more detailss.