- A $349 million current account surplus boosts morale.

- The lowest bond yields in several years are driving the market recovery.

- Banking, fertilizers and automobiles in the spotlight.

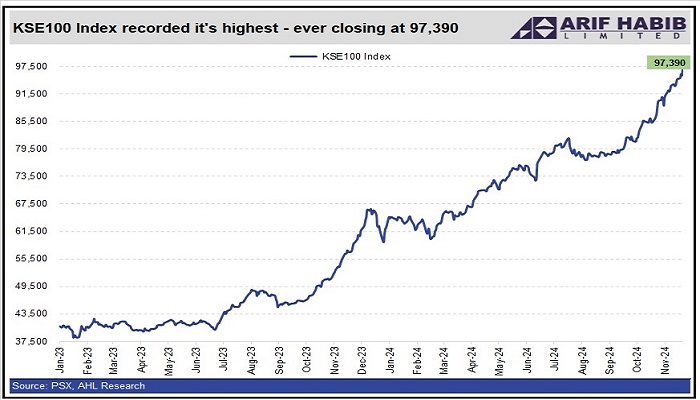

The capital market saw a massive rebound on Thursday, crossing the 97,000 mark for the first time, shrugging off the political uncertainty sparked by the call for “do or die” protests by the main party of opposition for November 24.

The Pakistan Stock Exchange (PSX) stock benchmark KSE-100 index surged 1,781.94 points or 1.86 per cent to close at an all-time high of 97,328.39 after touching an intraday high of 97,437.15 points.

Ahsan Mehanti, Managing Director and CEO of Arif Habib Commodities, also highlighted the factors behind today’s record rally, saying: “Stocks are bullish, led by scripts across the board, so as investors weigh on falling government bond yields and robust economic data on current account surplus, remittances. , exports and foreign direct investment.

“The increase in foreign exchange reserves and speculation on government decisions on economic reforms and privatization played a catalytic role in the record rise of the PSX,” he added.

The government raised 350 billion rupees through the auction of Pakistan Investment Bonds (PIB), surpassing the 300 billion rupees target, as yields on five- and 10-year securities fell to their lowest levels since March 2022.

“The central bank received bids amounting to Rs893 billion, against a target of Rs300 billion, giving a bid coverage ratio of 3.0x,” Arif Habib Limited said in a note.

The threshold yield on the two-year zero-coupon bond decreased by 19 basis points (bps) to 13.0%. At the same time, the threshold yield on three-year bonds remained unchanged at 12.5%.

Yields on five- and 10-year bonds also fell, falling by 9 basis points and 14 basis points, respectively, to 12.7% and 12.838%.

The current account surplus added another level of confidence, with the State Bank of Pakistan (SBP) reporting a surplus of $349 million for October 2024 – the third consecutive monthly surplus.

This improvement is attributed to a 7% month-on-month and 24% year-on-year increase in remittances. Foreign exchange reserves also reached their highest level in two years, boosting confidence in the country’s economic recovery.

In total, the current account surplus for the first four months of FY25 stood at $218 million, compared to a deficit of $1.53 billion during the same period last year .

Foreign direct investment (FDI) also showed robust growth, increasing 32% year-on-year to $904.3 million in the July-October period.

October saw a slight decline in FDI compared to the same month last year. Total foreign investment flows for the period reached $1.242 billion.

With reserves expected to exceed $11 billion in the coming weeks, local mutual funds have actively shifted their investments from fixed income to stocks, driving the benchmark index up 20% since september.

Commenting on the market recovery, Muhammad Saad Ali, Head of Research at Intermarket Securities Ltd, said: “Yesterday there was a healthy correction. The market has regained momentum and the range of rising stocks is widening to include more small and mid caps.

Buying was seen in several sectors, including automobile assemblers, commercial banks, fertilizers, pharmaceuticals and refineries.

The rebound follows a volatile midweek session that ended with a 310-point decline amid profit-taking and political uncertainty.

The political environment is tense, with the main opposition party planning a major protest in Islamabad on November 24, demanding electoral reforms and the release of its detained leaders and workers.

The protest, described as a “do or die” demonstration, has increased political uncertainty, further fueled by the government’s strong warnings of strict action against any unrest.

Meanwhile, security concerns and increased militant activity in the northwest regions have added to the unease, creating a difficult environment for investors.

The PSX witnessed sharp swings on Wednesday with the KSE-100 Index hitting a fresh intraday high of 96,711.33 points during morning trading before closing down 310.21 points at 96,381.21.