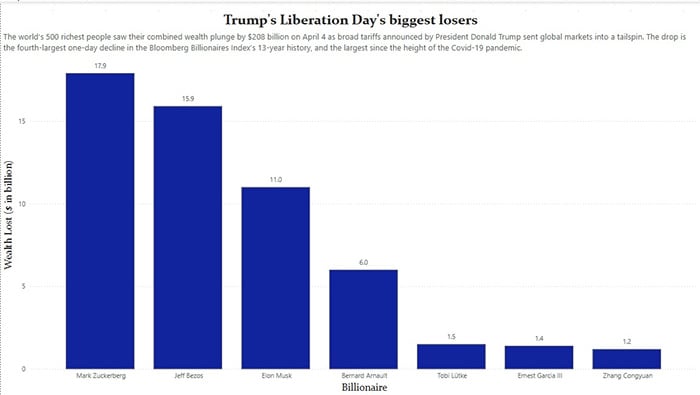

Last Thursday, the 500 richest people in the world saw their wealth combined plunging $ 208 billion while large prices announced by President Donald Trump sent global markets to a tailpin, reports Bloomberg.

The decline is the fourth drop by one day in the 13 years of history of the Bloomberg Billionaire index, and the largest since the height of the COVVI-9 pandemic.

In its report entitled “The billionaires Lost, 208 billion dollars in one day from Trump prices” published last week, Bloomberg Added that more than half of those followed by Bloomberg’s wealth index saw their fortune tumbling down, with an average drop of 3.3%.

In the United States, the billionaires were among the hardest, with Mark Zuckerberg of Meta Platform Inc and Jeff Bezos of Amazon.com included the way.

Carlos Slim, the richest man in Mexico, was part of a small group of billionaires outside the United States who escaped the impact of prices.

Mexican bolsa increased 0.5% after the country has been excluded from the list of reciprocal tariff targets of the White House, increasing the net value of Slim by around 4% to 85.5 billion dollars.

The Middle East was the only region where those who Bloomberg’s The wealth index caused net gains for the day.

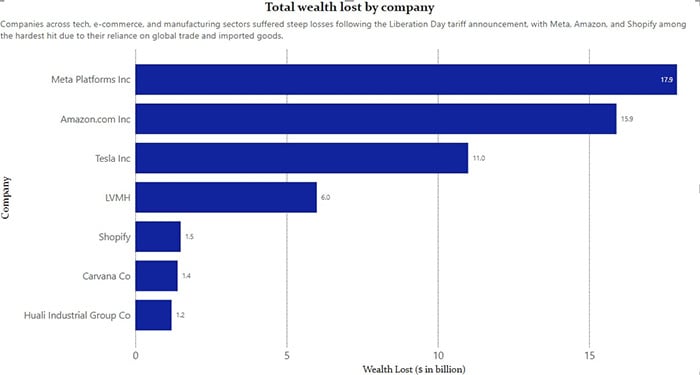

According to the report, here are some of the biggest losers of the day:

Mark Zuckerberg

The founder of Meta was the largest loser in dollars, the 9% slide from the social media company costing his chief executive to 17.9 billion dollars, or about 9% of his wealth. Meta was the out-of-competition winner among the magnificent Megacap Tech seven index of New Year’s shares in mid-February, over almost a month of consecutive gains to add more than $ 350 billion in market value. Since mid-February, however, the shares have dropped by around 28%.

Jeff Bezos

Amazon shares plunged 9% Thursday, their greatest drop since April 2022, costing the founder of the technology giant 15.9 billion dollars in personal wealth. The company’s shares are down more than 25% compared to its February summit.

Elon Musk

Tesla CEO has lost $ 110 billion so far this year – including $ 11 billion on Thursday – while late deliveries and its controversial role as TSAR for Trump’s efficiency hammered the stock of the electric vehicle manufacturer.

Earlier this week, things improved: because Tesla manufactures many of its cars in the United States, prices could have a lower effect on the company than its foreign peers.

His stock also joined information that Musk will soon withdraw from his government work to potentially refocus on Tesla. However, shares dropped 5.5% on Thursday after the prices were announced.

Ernest Garcia III

The richness of the CEO of Carvana Co fell $ 1.4 billion after the shares of the second -hand car seller lost 20%.

The company’s shares had jumped more than 425% in the 12 months until February 14, but have since dropped by 36%.

Tobi Lutke

The co-founder and CEO of the Canadian Electronic Commerce Company Shopify has lost $ 1.5 billion, or 17% of its fortune.

Shopify’s actions, which generates a large part of its income from imported goods sales, fell 20% in Toronto, because the S & P / TSX composite index has undergone its worst day since March 2020.

Bernard Arnault

The European Union is preparing for a new tariff at 20% on all products intended for the United States, which should harm alcohol and luxury exports, among others.

The LVMH of Arnault, a conglomerate which has marks like Christian Dior, Bulgari and Loro Piana, saw his actions fall in Paris, wiping $ 6 billion on the net value of the richest person in Europe.

Zhang Congyuan

The founder of the Chinese shoemaker Hudi Industrial Group Co. lost $ 1.2 billion, $ 13% of his fortune, while the 34% Trump rate on China sent the company’s shares.

Shoe manufacturers based in the United States and Europe also felt the pain: Nike Inc., Lululemon Athletica Inc. and Adidas AG, all of which have important manufacturing facilities in Southeast Asia, each fell with two figures.